Therefore, Google is trading at only 17 times forward earnings estimates. Consensus EPS estimates are for $6.14 in 2023. EPS Estimatesĭespite a slight decline this year, Google should return to robust EPS growth as the company advances. With booming sales, Google should deliver substantially more profits for shareholders simultaneously. Therefore, the company could provide more than $400 billion in sales by 2025.

The company's double-digit revenue growth should continue through 2025 and probably longer. Remarkably, Google will probably make more than $100 billion per quarter soon. Google - On Its Way to Making $100 Billion Per Quarter Revenue Projections The increased efficiency should offset some of the impacts from slower growth and inflation, softening the overall blow from the economic slowdown. Therefore, Google will probably focus on increasing efficiency, which should translate into improving margins and higher profitability in the coming quarters. The company said it would "slow" the hiring rate through 2023, as even Google is not immune to economic headwinds. Google's employee count increased significantly by almost 21% to more than 174,000 YoY. Cloud revenues came in at nearly $6.3 billion, illustrating a significant 36% YoY growth in Google's cloud segment. Google advertising provided approximately $56.3 billion in revenues, roughly 12% YoY growth. YouTube ads revenues came in at $7.34 billion, illustrating modest growth. This figure illustrates that despite the slowing economic conditions, Google's core Search segment continues firing on all cylinders, providing significant growth for the company. Google Search and "other" delivered about $40.7 billion in revenues last quarter, a 13.7% YoY gain. Moreover, the company's revenues increased by 12.6% YoY, illustrating continued robust growth for the tech giant. There were fears of a more significant miss, and it's constructive to see that Google's earnings are not deteriorating. However, despite the slightly lower-than-expected numbers, investors were pleased with the results. The company reported revenues of $69.69 billion, missing the estimated figure by $110 million.

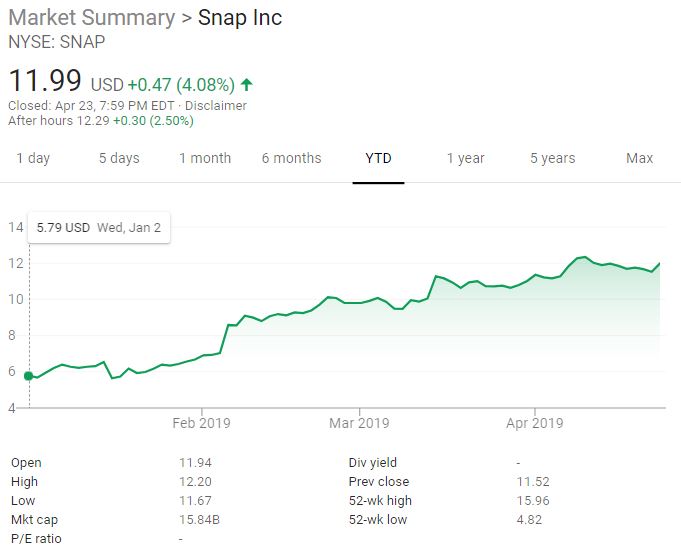

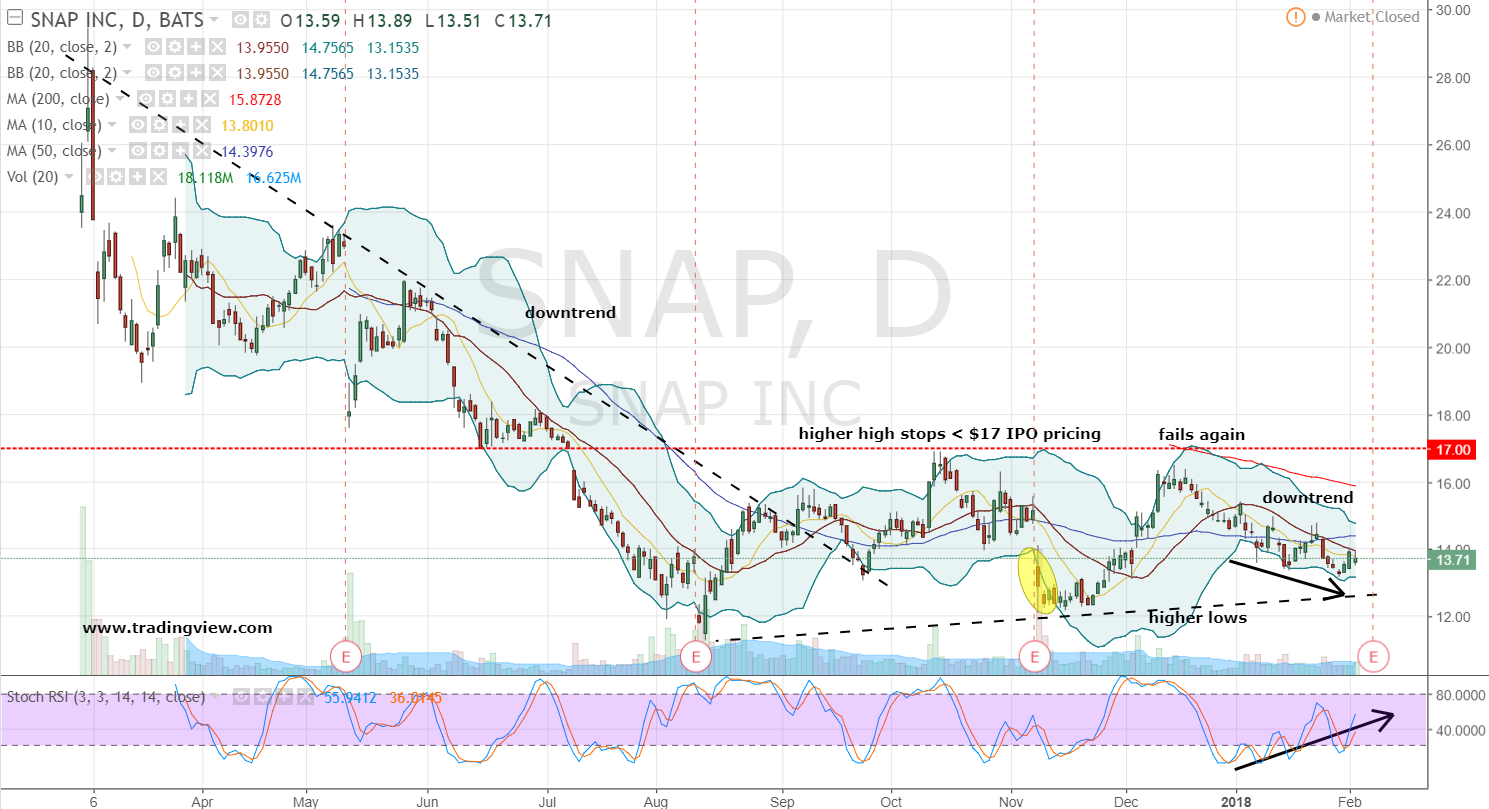

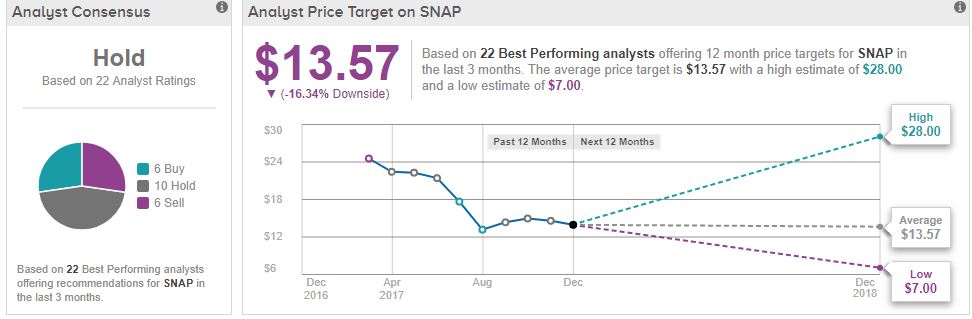

Google reported GAAP EPS of $1.21, missing consensus estimates by 6 cents. However, Google is much different, and the company is posting very different results. Snap's stock is down from a high of around $85 to just about $9 a share as the company's revenue growth has decelerated significantly. Snap's been delivering worsening results for several quarters now, and the company warned of deteriorating economic conditions in prior reports. However, Google isn't Snap, and not all companies that rely on ad sending are created equal. Snap also relies heavily on ad spending, and the company reported top and bottom line misses along with weak guidance. ( SNAP) experienced another epic drop recently after providing a horrible earnings report. Therefore, Google's stock represents a compelling long-term buying opportunity at current levels, and its share price should appreciate considerably as we advance. Moreover, Google should continue growing revenues and expanding EPS in future years, and the stock is relatively cheap here. Yet, the recent earnings report illustrates Google's resilience and implies that the company should weather the storm better than anticipated. Google's stock is down by about 30% from its ATH this year as concerns of an economic slowdown and a slowdown in ad spending linger. While the company's EPS and revenues came in slightly below forecasts, the general tone of the report was strong. Alphabet ( NASDAQ: GOOG) ( NASDAQ: GOOGL), also known as Google, reported Q2 earnings recently.

0 kommentar(er)

0 kommentar(er)